|

WHATSAPP NO. - +91 90950-00081,

CALL 24 X 7 : +91 90950-00081,

GET IN TOUCH - taxandfinanceservice@yahoo.com

|

|

We are a leading Service Provider of fssai registration service, fssai state license, fssai central license,

food license service and food license service in india.

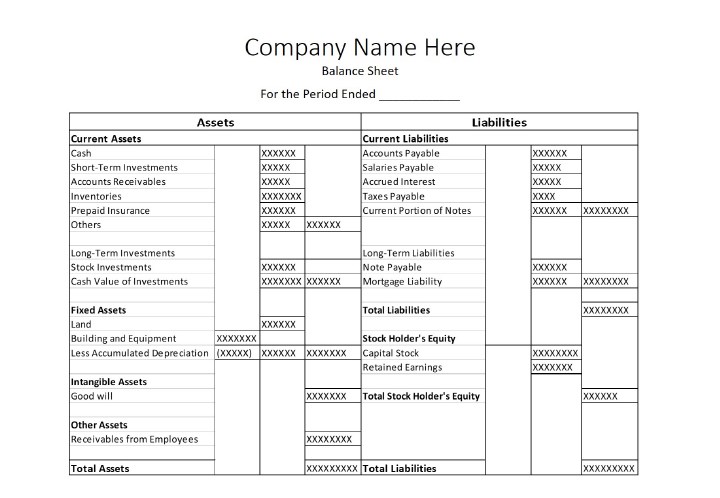

Balance Sheet is the financial statement of a company which includes assets, liabilities, equity capital,

total debt, etc. at a point in time.

Balance sheet includes assets on one side, and liabilities on the other.

The balance sheet is the most important of the three main financial statements used to illustrate the

financial health of a business.

The other two are the income statement and cash flow statement.

"For the balance sheet to reflect the true picture, both heads (liabilities & assets) should tally (Assets = Liabilities + Equity)."

Balance sheet is more like a snapshot of the financial position of a company at a specified time, usually calculated after

every quarter, six months or one year.

BALANCE SHEET HAS THREE MAIN HEADS:

Assets are the heart of a business. This is where you should spend most of your time when doing a balance sheet analysis.

Anything a company owns, tangible or intangible, that can generate revenue in the future, is its asset.

Accounting standards require that a possession be recognised as an asset only if its value can be measured reliably and if it can be sold separately. In addition to tangible or ‘hard’ assets, like land and machinery, companies own several intangibles that qualify as an asset. These include patents, copyrights, and trademarks. These cannot be touched or felt, but they can generate revenue, be valued reliably, and be sold separately.

Companies record assets as ‘current’ and ‘fixed’ on the balance sheet. Fixed assets include plant & machinery, land, and

building etc. All fixed assets, apart from land, lose value over time. This loss in value is called depreciation.

Assets are those resources or things which the company owns. They can be divided into current as well as non-current assets or long term assets. The assets side shows what a company owns, and the liabilities side shows what the company owes. Assets and liabilities are either ‘long-term’ or ‘current’. Long-term assets and liabilities stay with the company for more than a year. Current assets and liabilities normally have a life of less than one year. It is reported as an expense on the income statement each year. The value at which a fixed asset is recorded on the balance sheet is the differences between its purchase price and the total depreciation charged till the balance sheet date. The balance sheet generally starts with sources of funds. It shows all the current liabilities of the company, followed by its long-term debt and other long-term liabilities. For intangible assets, the annual loss in value is called amortization. It is treated identically to depreciation.

Liabilities on are debts or obligations of a company. It is the amount that the company owes to its creditors.

Liabilities can be divided into current liabilities and long term liabilities.

All outstanding financial obligations of a company are its liabilities.

Long-term liabilities mostly include debt that the company has raised for more than five years.

It can be in the form of money borrowed from a bank or funds raised through the sale of bonds (i.e. debentures).

Another asset source is equity. If you are the sole proprietor of your business, this is referred to as owner’s equity.

If your business is a corporation, equity is called stakeholder’s equity. When all liabilities are subtracted from your company’s assets,

the result is equity.

Equity is made up of paid-in capital and retained earnings. Paid-in capital is the amount each shareholder initially paid for his or her stock. Retained earnings refers to the amount of money your business didn’t sell to shareholders and instead reinvested into itself. Promoters sell some shares to investors or the general public to raise these funds. These shares are sold at a higher price or a premium on the original. The equity value you see on the balance sheet of a company is based on the original price. It is known as the book value of equity.

Balance sheets are also important because these documents let banks know if your business qualifies for additional loans or credit.

Balance sheets help current and potential investors better understand where their funding will go and what they can expect to receive

in the future. Investors appreciate businesses with high cash assets, as this insinuates a company will grow and prosper.

The balance sheet is the most important source of information about a company’s financial health.

This makes reading the balance sheet one of the most important skills you need as an investor.

FINANCETAXSERVICES.COM is providing the balance sheets at an affordable prices, on-time supply of the work.

If you require balance sheet then contact FINANCETAXSERVICES.COM 24 * 7 by email/whatsapp.

If you need the

Balance sheet preparation services,

GST registration and Company registration services

with us then we will take care for all of your tax needs 24*7*365 Days.

You can contact us at

We have served small, medium and big businesses fight the fear of taxation phantom through sound consultation and on-time service delivery for years.

We earned our reputation as a reliable tax consultant for businesses and individuals through its persistent commitment and a track record that speaks volumes of our credibility. Resellers you can also call and have a business tie up. Want to know more relating to FSSAI REGISTRATION, Email us on taxandfinanceservice@yahoo.com now and we would be happy to assist you! |

|

|

When we took the decision to invest in business in India, we were not sure on which structure to form for our Indian business. We have through their vast experience helped us to decide the same and build a strong business model. To achieve great things in life , "We must dream, plan, act and believe"

|

|

| |

|

OR EMAIL US : taxandfinanceservice@yahoo.com | |

|

|

|

|

Website Design, Developed and Marketed by:

https://digitalleworld.com/

|

Digital E-WORLD

|